About Chime verified account

Looking for a fast, reliable, and secure banking solution? Our Chime verified account are the perfect choice for anyone looking to take control of their finances. With a verified Chime verified account, you can access a full suite of banking services, including easy transfers, direct deposits, and a hassle-free mobile banking experience.

Key Features:

- Fully Verified: Accounts are pre-verified to ensure instant access.No Hidden Fees: Enjoy Chime’s fee-free banking model.Instant Transfers: Make quick transfers and payments without delay.

Mobile Banking: Access your account anytime, anywhere through the Chime app.

Secure: Protected with industry-leading security measures.

Why Choose Our Verified Chime Accounts?

Skip the lengthy verification process and start using your Chime verified account immediately. With easy access to all the benefits of Chime’s digital banking, you can enjoy seamless transactions, direct deposits, and fast account management—all in one place.

Perfect For:

- Individuals and businesses looking for a reliable banking solution.Quick access to direct deposits and fast money transfers.Those looking to avoid traditional banking fees and restrictions.

Note: Use responsibly in accordance with Chime’s terms of service.

Communicate with us For additional Inquiries- Tap here

What is Chime?

-

Chime is a fintech company—not a bank—that partners with The Bancorp Bank and Stride Bank, both FDIC‑insured, to offer banking services. Your deposits are covered up to $250,000 via those partner banks app.chime.com+15chime.com+15nerdwallet.com+15.

-

Founders Chris Britt and Ryan King launched it in 2012. It went public on June 12, 2025 under the ticker CHYM with an initial valuation near $11.6 billion en.wikipedia.org+1barrons.com+1.

Key Features

-

No hidden or monthly fees

-

SpotMe overdraft

-

Early direct deposit

-

High‑Yield Savings option

-

Credit Builder Card

-

ATM network & mobile app features

Pros & Cons

| Pros |

Cons |

| No monthly/minimum/overdraft fees (SpotMe is free) |

No physical branches—fully digital |

| Early pay access with MyPay |

Limited overdraft protection (max ~$200) |

| High-yield savings & credit building |

Cash deposits less convenient; may incur third-party fees chime.com+7chime.com+7chime.com+7en.wikipedia.org+1joingerald.com+1chime.comjoingerald.com |

| Clear and transparent fee structure |

Mixed customer service experiences—some account closures reported |

Customer Feedback

-

Many users praise Chime for transparency and ease of use:

“One of the most refreshing aspects of Chime is its commitment to transparency… saved me a significant amount of money” wise.com+15chime.com+15chime.com+15

-

However, complaints exist about customer support and potential scams:

“Chime is a poorly designed payment method that favors scammers… Chime refuses to help” depositaccounts.com

-

Regulatory actions in 2024 imposed fines for delayed refunds and inadequate complaint resolution. A grade‑B rating from BBB reflects ongoing improvements en.wikipedia.org.

Recent & Noteworthy Updates

Is Chime a Good Fit for You?

Ideal for you if:

-

You prefer no monthly fees and mobile-only banking.

-

You’re comfortable using debit and building credit with a secured card.

-

You want perks like early pay and free overdraft.

Might not be ideal if:

Next Steps

-

Visit Chime.com or install the app to open an account. It takes under 2 minutes, and there’s no credit check .

-

Set up direct deposit to unlock early pay, fee-free overdrafts, and earn on your savings.

-

Explore Credit Builder if you want to build your credit history at no cost.

-

Stay aware that as a tech company—not a traditional bank—you’re reliant on their systems and customer support rather than branch-level help.

✅ Summary

Chime offers a modern, mobile-first banking experience with no monthly fees, early paycheck access, fee-free overdrafts, and tools like high-yield savings and Credit Builder. It’s great for tech-savvy users focused on convenience and cost-saving. However, it may not suit those looking for in-person banking, extensive financial services, or larger credit/overdraft limits.

Kyc Face Bypass Tools

Kyc Face Bypass Tools

Cash App LD Method

Cash App LD Method

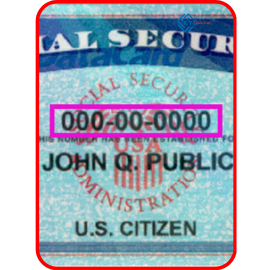

SSN Fresh USA

SSN Fresh USA

Stripe Account Buy

Stripe Account Buy

Reviews

There are no reviews yet.