✅ Bluebird Account with Virtual visa card

✅ Full Account Access

✅ Browser & App

✅ USA verified

✅ 100% Trusted & Secure

✅ Fast Delivery (Follow Delivery Policy)

️ What Is Bluebird?

-

A prepaid debit/checking account launched in 2012 by American Express and Walmart on the Amex Serve platform reddit.com+15corporate.walmart.com+15businesswire.com+15.

-

Funds are held in FDIC‑insured custodial accounts (via Wells Fargo/Centurion Bank), offering up to $250,000 protection on permanent Bluebird accounts businesswire.com+3paymentsjournal.com+3depositaccounts.com+3.

-

Offers a fully digital experience, with no physical branches.

Key Features

-

No monthly fee, activation fee, annual fee, or overdraft fees corporate.walmart.com.

-

Free direct deposit (salary, tax refunds, Social Security), often arriving up to two days early fintechfutures.com+12depositaccounts.com+12businesswire.com+12.

-

Zero-fee cash-loading at Walmart registers; fees apply at other retailers (e.g., ~$3.74 at Walmart post-June 2023) fintechfutures.com+10bluebird.com+10reddit.com+10.

-

MoneyPass ATM access—22,000+ machines with no fee if direct deposit is enabled; otherwise standard network fees apply marketscreener.com+1reddit.com+1.

-

Mobile check deposit, eGift/American Express Offers, and perks like fraud protection, ride assistance, and more through Amex reddit.com+8depositaccounts.com+8cutimes.com+8.

-

Sub-accounts (“SetAside” or family accounts)—up to 4, though interest is not earned reddit.com.

-

Prepaid checks—you can order and write checks with pre-authorized funds, no overdraft risk .

-

Annual load cap of $100,000, with daily/monthly limits on deposits businesswire.com+1aol.com+1.

Pros & Cons

Pros

Cons

-

Feature reductions announced: sub-accounts, goals, Amex Offers, and check-writing are scheduled for discontinuation on September 10, 2024 reddit.com.

-

Cash reload fees introduced at Walmart and Family Dollar; network support less consistent reddit.com+5bluebird.com+5reddit.com+5.

-

No interest on savings, and no credit-building features.

-

Account suspensions or closures have been reported, sometimes with minimal notice reddit.com+2reddit.com+2reddit.com+2.

-

Fraud incidents and disputes are not uncommon, with mixed resolution experiences .

Recent Changes & Status

-

September 10, 2024: Amex announced removal of important features—Goals, sub-accounts, Amex Offers, and check-writing—likely signaling a gradual wind-down .

-

July 2023: Walmart introduced a $3.74 fee for cash reloads, while Family Dollar remains free bluebird.com+1reddit.com+1.

-

Reduced Walmart presence: Bluebird cards are no longer available via Walmart, with some users noting a shift toward One by Walmart accounts reddit.com+15reddit.com+15reddit.com+15.

Who’s It Best For?

-

Good fit if you want a no-fee, prepaid checking alternative with early pay, FDIC protection, and Amex perks.

-

Not ideal if you rely on features being discontinued (like sub-accounts or check-writing), need interest earnings, or want strong fraud/dispute handling.

⚠️ Caution & Watchpoints

-

Monitor for feature removals and fee changes—Bluebird appears to be phasing out key capabilities.

-

Watch your mail and load options, as reload methods and associated fees/fluctuations have been inconsistent.

-

Be aware of account limitations or closures; backups for direct deposit are advised.

✅ Final Take

Bluebird started as an outstanding low-cost, flexible prepaid checking option with solid benefits. However, since mid-2023, its feature set has been shrinking, and key conveniences like sub‑accounts and free reloads at Walmart are disappearing.

If you’re already using it, keep benchmarking it against other fee-free or low-cost fintech banking options like Chime, Go2bank, or One, especially given Bluebird’s diminishing value.

Would you like help comparing Bluebird vs. newer fintech accounts, or advice on transitioning to another service? I’m happy to jump in!

Kyc Face Bypass Tools

Kyc Face Bypass Tools

Cash App LD Method

Cash App LD Method

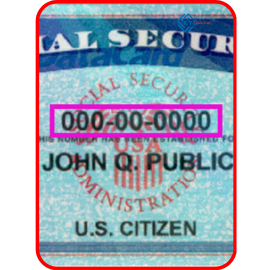

SSN Fresh USA

SSN Fresh USA

Stripe Account Buy

Stripe Account Buy

Reviews

There are no reviews yet.